Ethereum ICO Investor Sells Holdings when ETH Price Surge to $3,000

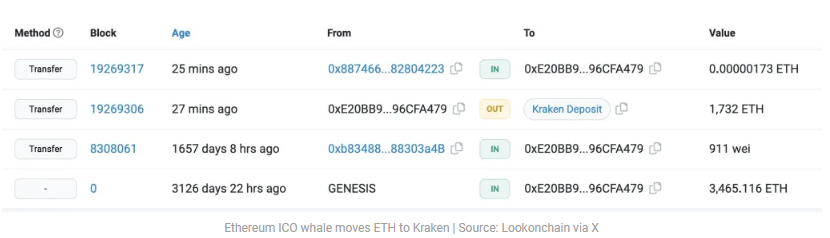

According to recent news, a large Ethereum ICO investor has sold their holdings following the surge in ETH price to $3,000.

However, it is worth noting that there are other reports indicating that accumulation of ETH is increasing despite the price surge, and that the on-chain data of the Ethereum network is signaling a fertile ground for further growth of the asset.

Large Ethereum ICO Investor Sells Holdings Following ETH Price Surge to $3,000. Is it Bullish or Bearish?

Additionally, a long-dormant ETH whale has recently reactivated their $10.4 million wallet. Overall, the current outlook for Ethereum is positive, with high speculative interest and a strong network supported by an increase in the number of validators and coins locked in staking.

The action taken by the large Ethereum ICO investor who sold their holdings following the ETH price surge to $3,000 cannot definitively be classified as either bullish or bearish alone. Instead, it provides insight into one specific actor’s viewpoint regarding the market. Based on the information provided, here are some considerations:

- The sale occurred while ETH was experiencing a significant price rise, suggesting that the seller believed the asset had already achieved its objective at that price point.

- The fact that the seller made a considerable profit on the trade also implies that they were confident in the asset’s ability to continue appreciating.

- At the same time, the sale could indicate that the seller believes the market is overheated and ripe for a pullback.

- Concurrently, the broader context of the market includes signs of continued accumulation and positive on-chain metrics, such as a high percentage of profitable addresses and increasing open interest in derivatives.

Given these factors, it would be premature to conclude that the sale represents a clear signal of either a bullish or bearish stance for the entire market. Rather, it should be viewed as a single event that reflects the perspective of one individual investor amidst a complex and dynamic environment. To make a more informed assessment, it would be necessary to analyze the market as a whole, including various on-chain and fundamental indicators.