Chinese Central Bank Official Foresees a Retail Payment Revolution with Digital Yuan

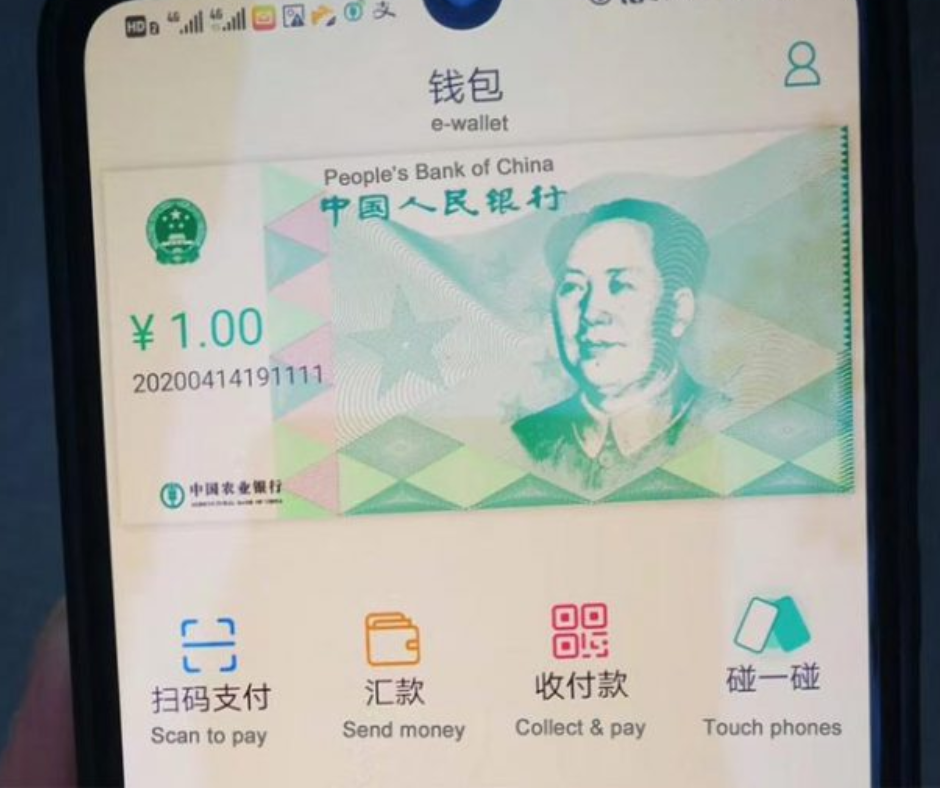

The head of Chinese central bank’s digital currency research institute, Mu Changchun, believes that the digital yuan will change how people in China make everyday payments and may eventually replace cash.

He spoke about this at the China International Financial Annual Forum. He emphasized the importance of ensuring that the digital yuan is accepted for all kinds of payments in China.

Mu also called on the central bank’s partners in the banking and electronic payment industry to make their technical systems more compatible, especially their QR code protocols. Currently, digital wallets are provided by the central bank and a few state-run banks.

Big private-sector payment services like WeChat Pay and Alipay have added support for digital yuan, but they integrate it with their own systems rather than with each other’s. This can cause issues for merchants using point-of-sale devices.

Experts suggest that having a standardized QR code that works for digital yuan, Alipay, WeChat Pay, and other electronic payments could make it more convenient for everyone involved, encouraging wider adoption of digital yuan for retail payments.

Mu also mentioned that the partners in the banking and electronic payment sector need to make various upgrades to promote the use of the digital yuan in everyday retail payments. Some analysts think that Mu’s comments were aimed at retailers, encouraging them to be ready to accept digital yuan payments when customers want to use them.

Here are some key points about the digital yuan:

- The digital yuan is a digital version of China’s national currency, the yuan or RMB.

- The digital yuan is issued directly by the PBOC and does not depend on a blockchain.

- The digital yuan can be used for retail payments and money transfers.

- The digital yuan is part of China’s broader push to digitize its economy and reduce its reliance on cash.

- The digital yuan is being tested in various cities in China, with the PBOC distributing 10 million e-CNY to Shenzhen residents in April 2020.

- The digital yuan is designed to complement existing payment systems, but could in principle increase the amount of digital payments made in China.

- The digital yuan is being encouraged by the Chinese government and local authorities, with trials beginning in cities in Fujian province.

The digital yuan has the potential to revolutionize payment systems in China and beyond. However, it is important to note that the digital yuan is not a cryptocurrency like Bitcoin and is subject to government control and surveillance.